Canada-China 2026 Electric Vehicle Agreement: Towards a New Era for Charging Infrastructure

Montreal, January 16, 2026

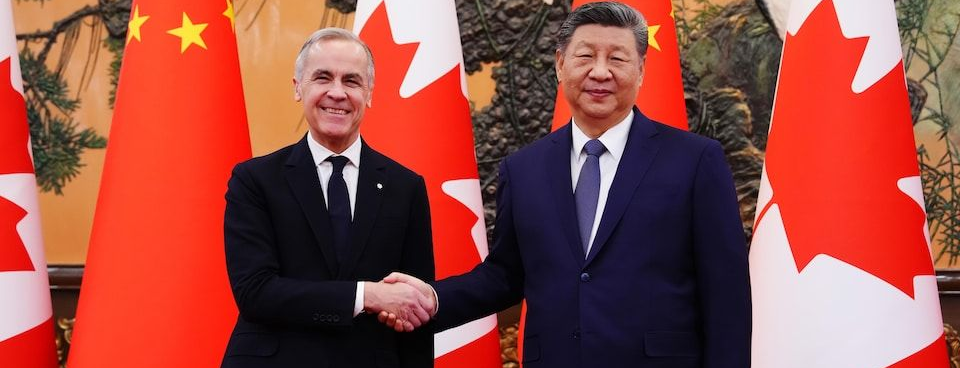

The year 2026 marks a significant turning point in economic relations between Canada and China with the signing of a strategic trade agreement that includes a component on electric vehicles (EVs). This agreement, concluded during Prime Minister Mark Carney's official visit to Beijing and signed with President Xi Jinping, has direct repercussions on the electric vehicle market, supply chains, and, more broadly, on charging infrastructure needs.

For B2B players in the electric vehicle charging station installation sector for condominiums and multi-unit residential buildings, this agreement opens up concrete prospects and requires a thorough understanding of the opportunities and challenges ahead. This text explores the agreement in detail, its implications for the Canadian EV market, and what it means for charging station installations for condominiums and building managers.

1. Context of the Canada-China agreement

The agreement signed in January 2026 is part of a broader framework of trade cooperation between Ottawa and Beijing, aimed at strengthening the bilateral relationship after several years of tensions and high tariffs on both sides.

At the heart of this agreement:

- Significant reduction in tariffs on Chinese electric vehicles imported into Canada, from a rate of 100% to 6.1%, with an import quota of 49,000 units per year, expandable to approximately 70,000 in five years.

- Beijing's commitments to reduce tariffs on Canadian agricultural products, including canola seeds, in exchange for access to the Canadian market for EVs.

- Inclusion of sections on energy, clean technologies, climate competitiveness and joint investments in key supply chains.

The agreement is not a comprehensive free trade agreement, but rather a targeted strategic agreement that adjusts specific tariff barriers while promoting investment and increased cooperation in areas of mutual interest.

2. Why is this agreement important for the electric vehicle market in Canada?

2.1. Market recovery and diversification of supply

With the controlled opening of the Canadian market to preferential rates for Chinese electric vehicles, the EV sector in Canada is experiencing a new dynamic of competition. These vehicles represent a growing share of the global vehicle fleet thanks to competitive manufacturing costs and accelerated innovation in this sector in China.

For companies and property managers, this means:

- A forecast of growth in the EV fleet in Canada, particularly with models whose import price could be significantly lower.

- An increased need for charging infrastructure adapted to a diverse fleet of electric vehicles.

- Pressure is being put on the performance, compatibility and safety standards of terminals, as battery and connector characteristics can vary between manufacturers.

2.2. Impact on the adoption of electric vehicles in large residential communities

The multi-unit residential and condominium sector is particularly sensitive to changes in the EV market. Unlike individual buyers, property managers must plan and invest in infrastructure that:

- They anticipate the growth in the number of EVs among residents and visitors.

- They incorporate smart charging solutions, capable of managing energy demand without overloading the grid.

- They meet sustainability and regulatory compliance standards, often required by municipalities and regulatory bodies.

An agreement such as the one reached in January 2026 helps to legitimize solid growth forecasts for the EV market, which encourages more investors and owners to consider installing charging stations as a profitable medium- to long-term investment.

3. Consequences for the B2B charging station ecosystem

3.1. Accelerated demand for charging in residential buildings

One of the first direct effects of the growth in EVs is the increased demand for reliable and scalable charging infrastructure in residential buildings. Specifically:

- Property managers and co-ownership associations must integrate charging stations into their infrastructure maintenance and improvement plans.

- Real estate investors need to assess the added value of charging stations in rental optimization and resale.

- B2B installation providers are becoming strategic partners for the energy transformation of properties.

The Canada-China agreement, by promoting greater availability and diversity of electric vehicles, serves as an additional incentive for these players to accelerate their installation projects.

3.2. Opportunities for B2B companies specializing in charging stations

For a company specializing in the installation of charging stations in condos and multi-unit residential buildings, several opportunities are emerging:

a) Strategic advice to condo owners

Property managers don't always have the in-house expertise needed to navigate the technical, financial, and regulatory challenges associated with installing charging stations. B2B companies can offer:

- Customized feasibility analyses.

- Energy integration plans tailored to the specific constraints of each building.

- Comprehensive services including selection, installation and maintenance.

b) Implementation of scalable solutions

Modern buildings require charging infrastructure capable of:

- Manage the load intensity according to the needs of residents and peak periods.

- To integrate with smart management platforms and photovoltaic or energy storage systems.

- Offering flexible billing options, per user or per consumer, with appropriate digital tools.

c) Formation et support post-installation

A premium B2B service also includes training for managers and ongoing technical support to ensure:

- The reliability of the installations.

- Compliance with municipal and provincial standards.

- Optimizing energy costs through intelligent charging management.

4. Challenges and considerations to anticipate

Even though the Canada-China agreement provides a favorable framework for the growth of the EV market, certain strategic questions remain important for B2B companies and their clients:

4.1. Terminal compatibility and safety standards

The increasing diversity of EV models implies:

- Challenges related to compatibility with different charging standards (AC vs DC, power levels, etc.).

- A need for certified equipment that conforms to international standards.

- A need for integration with existing building management systems.

4.2. Geopolitical and economic concerns

The Canada-China trade agreement is not without its critics. Some observers believe that such an opening could:

- Putting the local automotive industry under competitive pressure without immediate guarantees of direct investment in domestic manufacturing facilities.

- To generate internal or external political reactions, particularly from traditional trading partners.

For B2B companies, these geopolitical dimensions mean that forecasts and strategies must remain flexible and integrated with a longer-term vision of the market.

5. Conclusion: Leveraging the agreement to accelerate electromobility

The January 2026 Canada-China agreement on electric vehicles is a major event that influences not only bilateral trade relations, but also the trajectory of electromobility in Canada.

For the B2B sector of installing electric vehicle charging stations in condos and multi-unit buildings, this agreement:

- Reinforces the anticipated growth of the electric vehicle fleet in Canada.

- Creates new business opportunities for charging solution providers.

- Encourages the proactive integration of smart charging technologies in residential and commercial buildings.

As demand for EVs continues to grow — thanks to more affordable vehicles and more open trade policies — companies specializing in charging will have a strategic role to play in helping real estate market players successfully transition to sustainable and connected mobility.